Stablecoin and Payments

Stablecoin & Payments

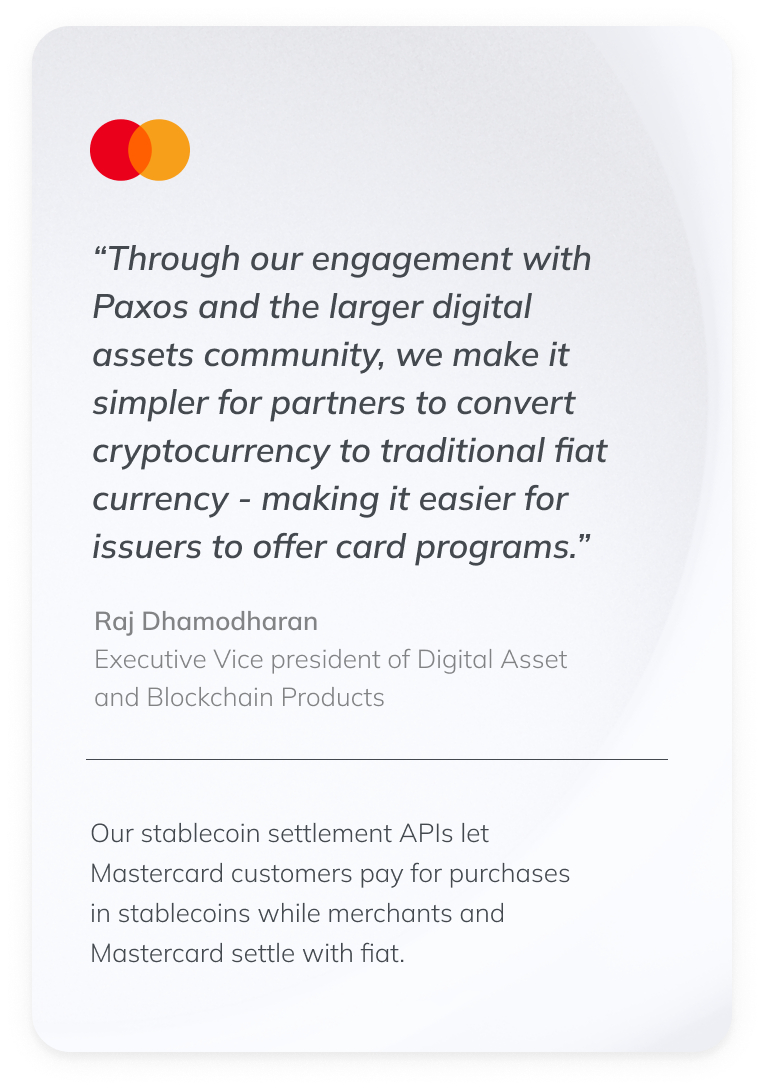

Blockchain-based solutions for payments, money movement and settlement.

Trusted by the World’s Leading Financial Services Companies

Built to Keep Your Customer’s Assets Safe

Understanding the difference between a regulated custodian with a trust charter like Paxos and stablecoin issuers with money transmitter license (MTL) registrations.

Trust Charter vs. Money Transmitter License

Trust Charter

Money Transmitter License

Qualified custodian

Required to hold customer funds segregated from company funds

Holds all client assets bankruptcy remote by law*

Cannot use customer funds to facilitate other business

*This is a distinguishing feature of Paxos-issued stablecoins from MTL-based and unregulated stablecoin issuers. If MTL-based and unregulated stablecoin issuers become insolvent, customers would become exposed to delays, and courts could determine customer assets belong to the senior creditors of the issuer’s bankruptcy estate.

Built to Keep Your Customer’s Assets Safe

Understanding the difference between a regulated custodian with a trust charter like Paxos and stablecoin issuers with money transmitter license (MTL) registrations.

Trust Charter vs. Money Transmitter License

Qualified custodian

Trust charter

MTL

Required to hold customer funds segregated from company funds

Trust charter

MTL

Holds all client assets bankruptcy remote by law*

Trust charter

MTL

Cannot use customer funds to facilitate other business

Trust charter

MTL

*This is a distinguishing feature of Paxos-issued stablecoins from MTL-based and unregulated stablecoin issuers. If MTL-based and unregulated stablecoin issuers become insolvent, customers would become exposed to delays, and courts could determine customer assets belong to the senior creditors of the issuer’s bankruptcy estate.

Paxos Payments Solutions

Transfers

Global, instantaneous money movement

Crypto Rewards

Reward users with cryptocurrencies

Whitelabel a Stablecoin

Your own branded digital dollar

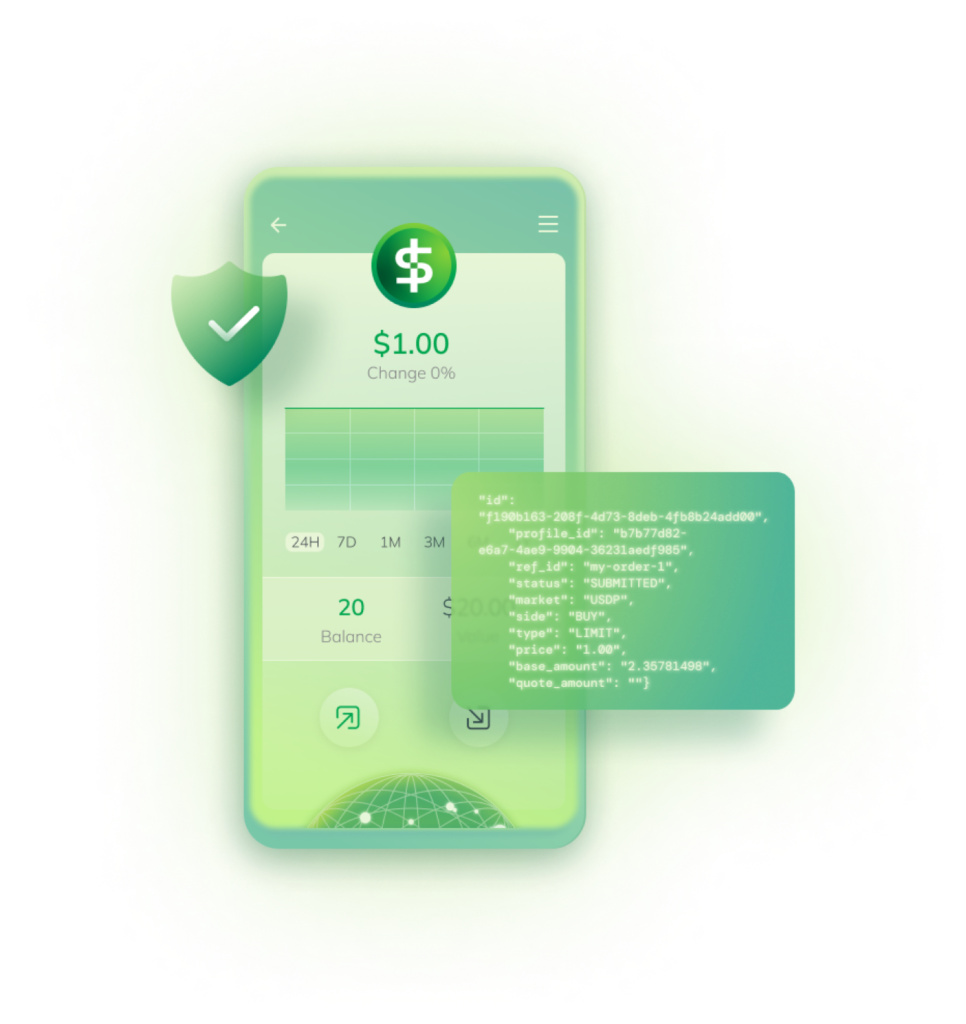

Paxos Stablecoins

Digital dollars that always equal a dollar

Regulated

Highest industry standards

Paxos stablecoins – and their reserves – are subject to strict regulatory oversight by the New York State Department of Financial Services, meeting the highest standards of consumer protection.

1:1 Redemption

Always available

Reserves are held 100% in cash and US treasuries, meaning that customer funds are always available for 1:1 redemption.

Bankruptcy Remote

Assets fully segregated

In the event of Paxos Trust’s insolvency, New York banking law protects customer assets from being used to satisfy the debt of Paxos. All assets are held bankruptcy remote in segregated accounts.